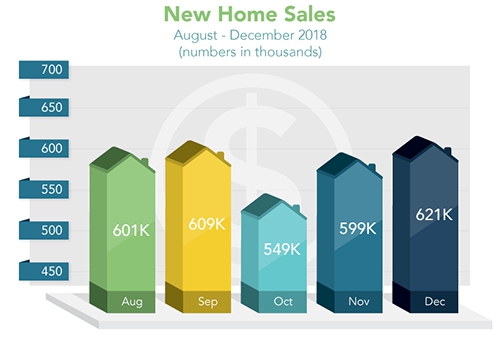

The Census Bureau reports that New Home Sales rose 3.7% in December to an annual rate of 621,000 units, a seven-month high and above the 572,000 expected. Sales were down 2.4% from December 2017 to December 2018 while sales for November were revised lower

Mar 05, 2019 | Mortgage News

When you get a mortgage to buy a home it’s important to understand the breakdown of your monthly mortgage payment. This will help you keep track of your finances, and to help you figure out your timeline of when you should be able to pay off your Ut

Mar 04, 2019 | Home Buying or Selling Mortgage Basics

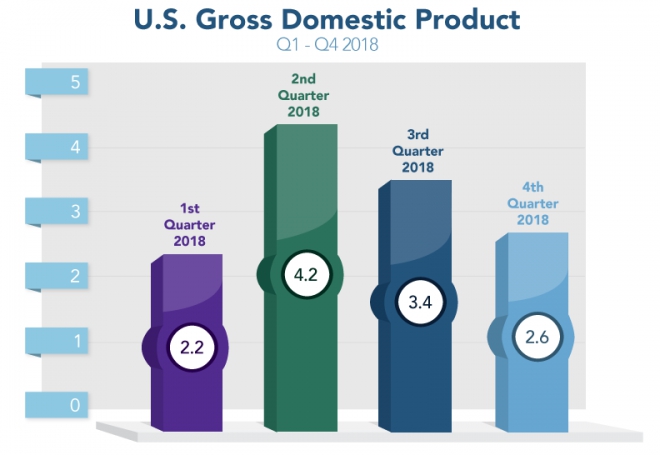

This past week, the Bureau of Economic Analysis (BEA) reported the U.S. economy, as defined by Gross Domestic Product (GDP), grew at a 2.6% rate in the fourth quarter of 2018. Economists and the markets were expecting 2.0% to 2.3%, so this was a nice upsi

Mar 01, 2019 | Mortgage News

Going through a bankruptcy, either personally or with your business, can affect your ability to qualify for a mortgage. Your credit score may drop, and you may need to wait before applying for a home loan. It all depends on the size of your down payment a

Feb 27, 2019 | Credit Home Buying or Selling

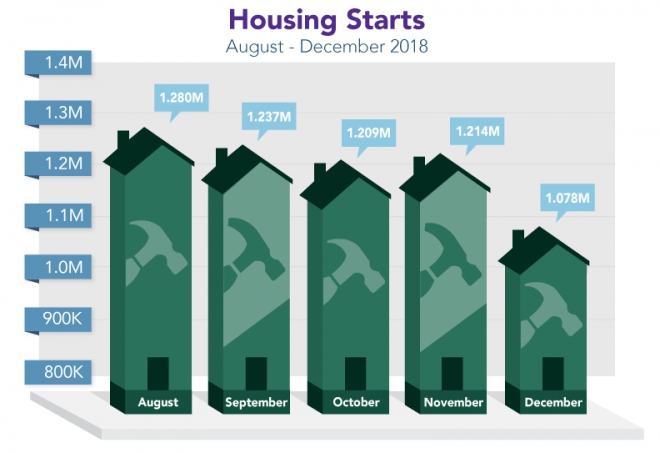

Delayed December Housing Starts fell 11.2% from November to an annual rate of 1.078 million units versus the 1.254 million expected. It was the slowest pace since September 2016. Building Permits were essentially unchanged at 1.326 million versus the 1.29

Feb 26, 2019 | Mortgage News

When you need a chunk of cash for a project, your home may be the best source of funding. Fortunately, you do not need to sell your home to take advantage of your equity. There are two popular and practical ways to pull cash out of your home: a cash-out r

Feb 20, 2019 | Home Equity Loans Refinancing a Home