When you are ready to apply for a mortgage loan, your mortgage broker will ask you for all sorts of financial information. One of the things lenders do with this data is to calculate your debt-to-income (DTI) ratio. A DTI ratio is one of the most basic me

Apr 17, 2019 | Mortgage Basics Credit

Initial Jobless Claims is a weekly report that tracks how many people have filed for unemployment benefits. It is both a solid gauge on the state of the labor market and economy and a leading indicator on what to expect in the months ahead. So, what are

Apr 12, 2019 | Mortgage News

4 Simple Ways to Get - and Benefit from - Client Feedback These days, getting feedback from your clients is often just an email, web form or social media post away. Before feedback gets buried in your inbox or lost in your feed, grab it and grow from it.

Apr 12, 2019 |

One of the biggest obstacles to homeownership is coming up with enough money for a down payment. When your own savings are not adding up quickly enough and you don’t have a rich uncle to tap for an early inheritance, you may find some help in a down

Apr 10, 2019 | Home Buying or Selling First-time Homebuyers

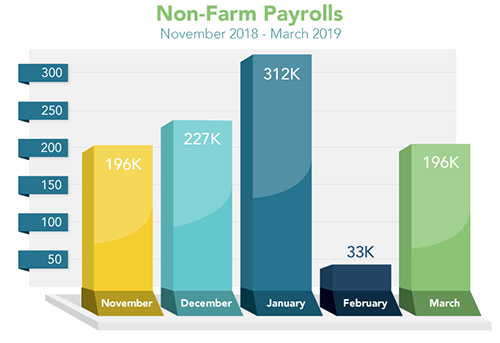

The Bureau of Labor Statistics reports that payroll growth rebounded in March after the weak reading in February. Non-Farm Payrolls rose 196,000 last month, above the 175,000 expected and above the 33,000 created in February. For January and February, upw

Apr 05, 2019 | Mortgage News

U.S. mortgage rates plummeted last week, as investors continue to fear slower international economic growth. According to Freddie Mac, the average rate on a 30-year fixed-rate mortgage (FRM) loan dropped to 4.06%, down from 4.28% the week before and the l

Apr 04, 2019 | Mortgage News