'Only got twenty dollars in my pocket' ...Thrift Shop by Macklemore & Ryan Lewis.

The financial markets are sensing a government shutdown and protracted trade war with China will be averted. This is good news and a reason why Stocks have continued to push higher and home loan rates have capped for the past few weeks.

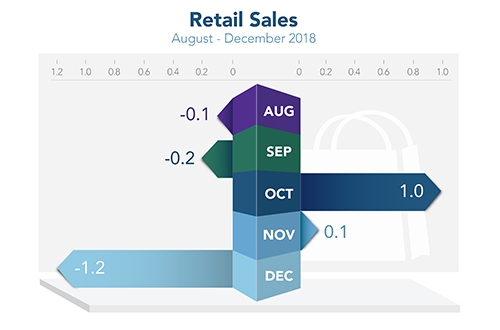

But last Thursday, Retail Sales was reported at a shocking 9-year low. Combing through the report, a 3.9 percent decline in internet purchases was a huge negative surprise. With consumer spending making up nearly 70 percent of GDP, there is fear in the markets that this very poor Retail Sales number is an early warning sign that both consumer spending and thus economic growth are indeed slowing.

One thing we know for sure -- Bonds love uncertainty and bad news. This Retail Sales report brought both and, as a result, pushed prices and home loan rates near the best levels in a year.

We will be watching future Retail Sales reports to see if this is just one bad report or the start of a negative trend.

In any case, reports like these support the Fed to not raise rates in 2019.

Additional Information >

Get a Lower Interest Rate

Get Quote

Vantage Production, LLC is the copyright owner or licensee of the content and/or information in this post, unless otherwise indicated.